What is a long position?

What is a long position? - Definition & explanation

Investors can earn money here and bet their invested capital on the corresponding price fluctuations of shares. There is the possibility of making profits with rising share prices, as the capital invested increases and can be sold at higher prices. On the other hand, traders can also bet on falling prices and profit from the sale of shares through corresponding financial products, mostly warrants.

In these two asset classes, the term long position stands for betting on rising share prices, which is the normal case. The opposite, i.e. investing on falling prices, can be described as both a short and a long position. This depends on the respective financial product.

Long positions on the stock market

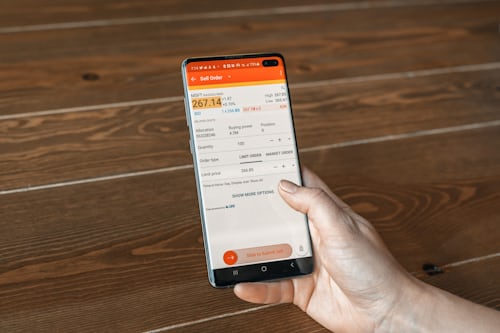

When looking at stock market prices, it quickly becomes clear that they only know two directions: Either the price rises or it falls. If a trader assumes that prices will rise due to higher demand, he buys shares in the hope of increasing his capital. In such a case, the trader is long a certain company and owns the corresponding shares. Normally, bullish traders take long positions based on optimistic markets. In this case, the investors buy shares in a company at the ask price (purchase price). The asset passes directly into the trader's possession via the share. The situation is similar with CFDs, although here the underlying assets do not pass into the investor's portfolio. A long position is often confused with the term longterm. However, longterm means that an investor wants to hold his financial product for a long time and assumes a long-term investment. A long position, on the other hand, does not indicate the length of the holding period. It is possible to hold it between a few seconds and several years. There is also the misconception that a long position always describes rising share prices, which will be cleared up in the following.

Special case of financial products based on stock market prices

In the area of real shares and CFD shares, the simple rule applies that a long position is taken when prices are expected to rise. Here are representation of right mindset by thai traders:

ในกรณีเช่นนี้ความสัมพันธ์ระหว่างราคาที่เพิ่มขึ้นและคํายาวนั้นถูกต้อง. อย่างไรก็ตามยังเป็นไปได้สําหรับผู้ค้าใน โบรกเกอร์ exness ที่จะดํารงตําแหน่งที่ยาวนานแม้จะมีราคาที่ลดลง. สิ่งนี้มีพื้นหลังที่มีความยาวตามความเป็นจริงไม่ได้หมายถึงราคา แต่เป็นความปลอดภัย. ซึ่งหมายความว่านักลงทุนกําลังเดิมพันกับราคาที่สูงขึ้นของความปลอดภัยของเขา. นี่อาจเป็นใบสําคัญแสดงสิทธิบันทึกย่อที่น่าพิศวงหรือความปลอดภัยอื่น ๆ ที่ขึ้นอยู่กับราคาตลาดหุ้น.

In such a case, a correlation between rising prices and the word long is correct. However, it is also possible for a trader to hold a long position despite falling prices. This has the background that long in the actual sense does not refer to the price, but to the security. This means that an investor is betting on rising prices of his security. This can be a warrant, a knock-out note or any other security that is based on stock market prices.

For example, if a trader assumes that stock prices will fall, he buys a corresponding warrant that will rise in value when prices fall. Nevertheless, the investor is long in his particular warrant, since he hopes for falling prices, but still wants his purchased position to increase in value. This is referred to as a long put position.